Timeless Wisdom Of Charlie Munger

Introduction

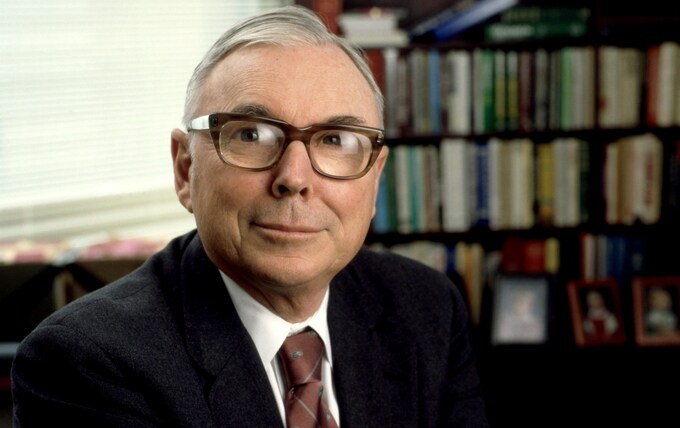

Charlie Munger(1924-2023)is my personal hero. His name synonymous with exceptional investing acumen and profound wisdom, has long been a beacon of inspiration in the world of finance and beyond. His partnership with Warren Buffett at Berkshire Hathaway has resulted in one of the most successful business stories of our time. However, Munger’s influence extends far beyond his investment strategies; his insights into human psychology, ethics, and life philosophy offer invaluable lessons to people in all walks of life.

Early Life and Career

Born in 1924 in Omaha, Nebraska, Munger’s early life and career laid the foundation for his later success. He attended the University of Michigan and later Harvard Law School, setting the stage for a successful career in law. However, his foray into the world of investment, where he eventually made his mark, was driven by a deep-seated curiosity and a desire to understand the intricacies of business and economics.

Investment Philosophy

Munger’s investment philosophy, often intertwined with that of Warren Buffett, is rooted in the principles of value investing—a concept pioneered by Benjamin Graham. This approach involves looking for securities that are undervalued by the market but have strong fundamentals. Munger’s unique contribution to this philosophy is his emphasis on the quality of the business and its management, rather than just the price of the stock.

The Munger Approach to Problem Solving

One of the hallmarks of Munger’s wisdom is his multidisciplinary approach to problem-solving. He advocates for a ‘latticework of mental models’—a concept that involves understanding the core principles from various disciplines and using them in an integrated manner to make better decisions. This approach not only applies to investing but to life decisions as well.

Key Principles and Quotes

Munger is known for his pithy and often brutally honest remarks. Some of his key principles include the avoidance of folly rather than seeking brilliance, the importance of patience in investing, and the need for lifelong learning. His famous quotes, such as, “It’s not supposed to be easy. Anyone who finds it easy is stupid,” reflect his straightforward and unapologetic style.

Wisdom in Life Beyond Investing

Charlie Munger’s wisdom transcends the boundaries of finance. He emphasizes the importance of ethical living and integrity, not just as moral imperatives but as practical tools for a successful and fulfilling life. He often speaks about the significance of hard work, humility, and the continuous pursuit of knowledge.

Influence and Legacy

Munger’s influence is evident in the success of Berkshire Hathaway and in the numerous investors and business leaders who cite him as a key influence. His legacy, however, will be in the timeless nature of his wisdom—principles that can be applied in varied contexts, by people from all walks of life.

Conclusion

Charlie Munger’s journey and teachings provide a roadmap not just for successful investing, but for successful living. His emphasis on simplicity, rationality, and ethical integrity offer a guiding light in an often complex and challenging world. As we navigate our own paths, Munger’s timeless wisdom stands as a testament to the power of clear thinking, lifelong learning, and steadfast adherence to one’s principles.

Post Comment