Margin Of Safety: The Most Important Concept For Value Investors

The concept of “margin of safety” is a fundamental principle in the world of investing and finance, originally popularized by Benjamin Graham, the father of value investing. This article delves into what margin of safety is, its importance in investment decisions, and how it can be applied in various financial contexts.

Understanding the Margin of Safety

Definition and Origins

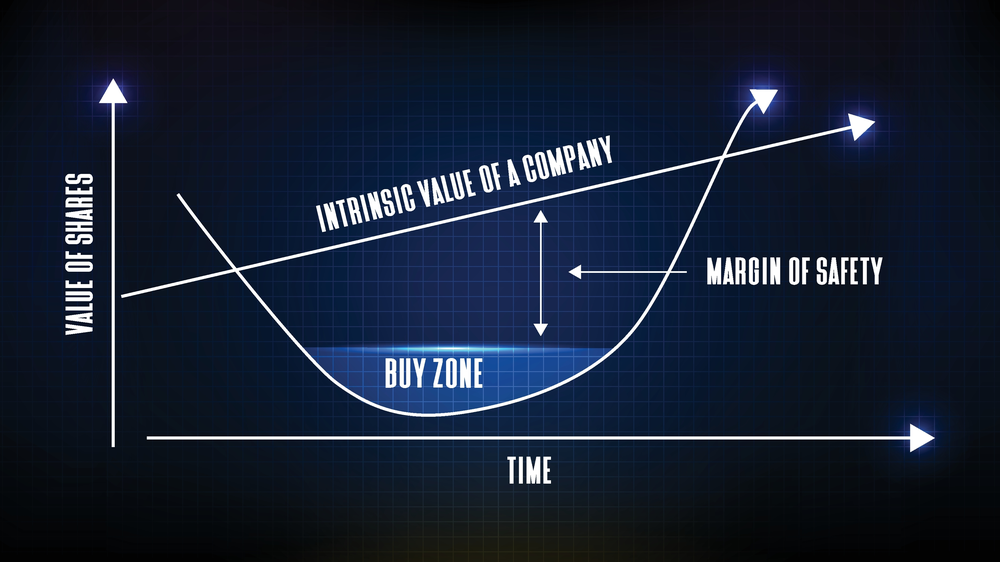

The margin of safety, at its core, is the difference between the intrinsic value of a security and its market price. Intrinsic value refers to what an investment is really worth, as determined through fundamental analysis, which considers a company’s assets, earnings, dividends, and financial strength. Benjamin Graham emphasized the importance of this concept in his book, “The Intelligent Investor,” advocating for the purchase of securities when the market price is significantly below its intrinsic value.

Rationale Behind the Concept

The idea behind the margin of safety is to minimize the downside risk. If an investor buys a stock for less than its intrinsic value, even if there are errors in the analysis or unforeseen market fluctuations, there’s a buffer to protect the investor from significant loss. It’s a principle that promotes the idea of ‘safety first’ in investing.

Importance in Investment Decisions

Risk Management

One of the primary reasons for employing a margin of safety is to manage risk. By insisting on a buffer between the price paid and the value received, investors can protect themselves against poor decisions and adverse market conditions. This is particularly important because predicting future stock performance involves uncertainty and the risk of being wrong.

Psychological Benefits

There’s also a psychological aspect to the margin of safety. It provides peace of mind, knowing that an investment has a built-in buffer. This can be crucial in volatile markets, where investor sentiment can swing wildly, leading to rash decisions.

Application in Various Financial Contexts

Stock Investing

In stock investing, the margin of safety involves buying stocks at a price significantly lower than their calculated intrinsic value. This approach is central to value investing, where investors look for undervalued stocks with strong fundamentals.

Bond Investing

For bond investors, the margin of safety might involve investing in bonds with a low risk of default and a high-interest coverage ratio. This ensures that even if the company’s earnings fluctuate, it can still cover its interest payments.

Real Estate and Other Investments

In real estate, the margin of safety could involve buying properties at a price below their estimated market value or replacement cost. Similarly, in other investments, it might mean investing at a point where the potential downside is limited due to inherent asset values or stable cash flows.

Calculating the Margin of Safety

Methods of Calculation

There’s no one-size-fits-all method for calculating the margin of safety. It varies based on asset class and individual investment strategies. However, it generally involves fundamental analysis to estimate intrinsic value and then determining the percentage difference from the current market price.

Factors to Consider

Several factors should be considered when calculating the margin of safety, including the quality of the company’s assets, its earnings stability, the predictability of its business model, and the overall economic environment.

Challenges and Considerations

Accuracy of Intrinsic Value

One of the biggest challenges in applying the margin of safety is accurately determining the intrinsic value of an investment. This often involves subjective judgments and assumptions, which can be prone to error.

Market Volatility and Investor Behavior

Market volatility can affect the margin of safety. A sudden market downturn can lead to situations where even securities with a seemingly strong margin of safety decline in value. Moreover, investor behavior, especially in times of market stress, can also impact the effectiveness of this strategy.

Conclusion

The margin of safety is a critical concept in the realm of investing, offering a systematic approach to risk management. It’s about ensuring a buffer between what you pay and what you believe an asset is worth, thereby reducing the potential for loss. While it’s not foolproof and relies heavily on the accurate calculation of intrinsic value, it remains a cornerstone of prudent investment strategy, particularly in value investing.

In conclusion, the margin of safety is more than just a financial metric; it’s a philosophy that emphasizes caution, rigorous analysis, and a focus on long-term value rather than short-term market fluctuations. For investors willing to do the homework and exercise patience, the margin of safety can be a powerful tool in building a resilient and profitable investment portfolio.

Post Comment