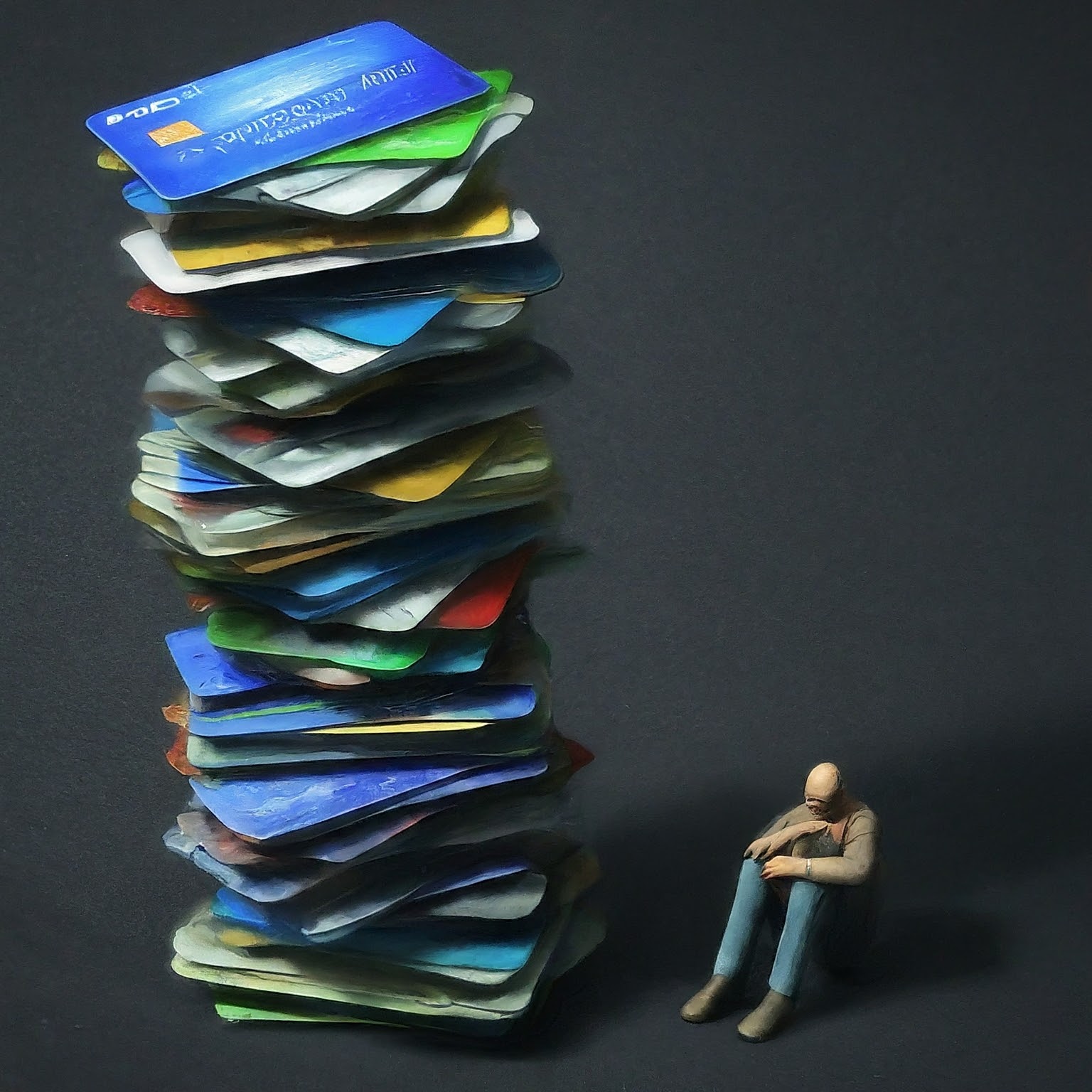

Conquering the Plastic Monster: Strategies to Slay Your Credit Card Debt

Credit card debt can feel like a never-ending mountain, looming heavy and casting a shadow on your financial well-being. But fear not, brave adventurer! With the right strategy and unwavering determination, you can slay this debt dragon and reclaim control of your finances.

In this article, we will explore various strategies to help you get rid of credit card debt effectively.

- Assess Your Debt: Start by making a list of all your credit cards, including the balance, interest rate, and minimum payment for each. This will give you a clear picture of your total debt and help you prioritize which cards to pay off first.

- Create a Budget: Develop a budget that accounts for all your income and expenses. Identify areas where you can cut back on spending and allocate the extra funds toward paying off your credit card debt.

- Choose a Repayment Strategy: There are two popular strategies for paying off credit card debt:

- The Avalanche Method: Focus on paying off the card with the highest interest rate first while making minimum payments on the others. Once the highest-interest card is paid off, move on to the next highest, and so on.

- The Snowball Method: Start by paying off the card with the smallest balance first while making minimum payments on the others. Once the smallest balance is paid off, move on to the next smallest, and so on. This method can provide quick wins and help build momentum.

- Consider a Balance Transfer: If you have good credit, you may qualify for a balance transfer credit card that offers a low or 0% introductory interest rate. Transferring your high-interest credit card balances to a card with a lower rate can save you money on interest and help you pay off your debt faster.

- Pay More Than the Minimum: Always try to pay more than the minimum payment on your credit cards. Even a small additional amount can significantly reduce the time it takes to pay off your debt and the total interest paid.

- Seek Professional Help: If you’re struggling to manage your credit card debt, consider seeking help from a reputable credit counseling agency. They can provide guidance, help you create a debt management plan, and negotiate with creditors on your behalf.

- Avoid Accumulating More Debt: While working to pay off your credit card debt, it’s crucial to avoid adding new charges to your cards. Stick to your budget and use cash or a debit card for purchases to prevent your debt from increasing.

Bonus Tip: Remember, credit card debt isn’t just a financial burden; it can impact your mental well-being. If you’re struggling, don’t hesitate to seek support from mental health professionals.

Conclusion: Getting rid of credit card debt requires a combination of strategic planning, discipline, and persistence. By assessing your debt, creating a budget, choosing a repayment strategy, and avoiding new debt, you can work your way towards a debt-free life. Remember, it’s important to stay motivated and focused on your goal, and don’t hesitate to seek professional help if needed.

Post Comment