Top 10 Games to Enhance Your Financial Literacy

Financial literacy is a crucial skill that can significantly impact your ability to manage money, make informed decisions, and achieve financial security. While traditional methods of learning finance, such as textbooks and courses, are valuable, games offer a fun and engaging way to grasp complex financial concepts. Whether you’re a student, a young professional, or someone simply looking to improve their financial acumen, these top ten games can help you learn essential financial skills in an interactive and enjoyable way.

1. Monopoly

Overview:

Monopoly is a classic board game that has been a household staple for decades. While it’s primarily known as a game of real estate, Monopoly also teaches valuable lessons about money management, investment, and strategic decision-making.

Financial Lessons:

- Cash Flow Management: Players must manage their cash flow carefully to avoid bankruptcy while strategically investing in properties.

- Real Estate Investment: The game encourages players to invest in properties and develop them to generate rental income.

- Risk and Reward: Monopoly teaches the importance of weighing risks against potential rewards, especially when deciding to purchase or develop properties.

Why It’s Effective:

Monopoly simplifies the complexities of real estate and finance into a fun, competitive game. The game’s mechanics mimic real-world financial decisions, making it a great tool for learning about investments and cash management.

2. Cashflow 101

Overview:

Created by Robert Kiyosaki, the author of “Rich Dad Poor Dad,” Cashflow 101 is a board game designed to teach players about investing, financial statements, and cash flow management. The game aims to help players understand how to achieve financial freedom by investing in assets that generate passive income.

Financial Lessons:

- Understanding Financial Statements: Players learn how to read and interpret income statements, balance sheets, and cash flow statements.

- Investing in Assets: The game emphasizes the importance of acquiring assets that generate income, such as real estate, stocks, and businesses.

- Achieving Financial Freedom: Cashflow 101 teaches players how to manage their finances to escape the “rat race” and achieve financial independence.

Why It’s Effective:

Cashflow 101 provides a hands-on approach to learning financial concepts that are often difficult to grasp. By simulating real-life financial scenarios, the game helps players develop a mindset geared toward financial success.

3. Financial Football

Overview:

Developed by Visa in collaboration with the NFL, Financial Football is an online game that combines the excitement of football with financial education. Players answer personal finance questions to advance down the field and score touchdowns.

Financial Lessons:

- Budgeting: The game teaches players how to create and stick to a budget, which is essential for managing personal finances.

- Saving and Investing: Players learn the importance of saving money and making smart investment choices.

- Credit Management: The game covers key concepts related to credit, such as maintaining a good credit score and managing debt.

Why It’s Effective:

Financial Football is an engaging way to learn about personal finance, especially for sports enthusiasts. The game’s competitive nature motivates players to improve their financial knowledge to win.

4. SimCity

Overview:

SimCity is a city-building simulation game where players act as the mayor of a virtual city. While the game is not solely focused on finance, it teaches important lessons about budgeting, resource management, and economic planning.

Financial Lessons:

- Budgeting and Resource Allocation: Players must balance the city’s budget, manage taxes, and allocate resources effectively to ensure the city’s growth and prosperity.

- Economic Planning: SimCity teaches players how to plan for long-term economic development by investing in infrastructure, public services, and environmental sustainability.

- Risk Management: The game introduces players to the concept of risk management, as they must deal with unexpected events such as natural disasters and economic downturns.

Why It’s Effective:

SimCity offers a unique perspective on financial management by placing players in charge of an entire city’s economy. The game’s complex scenarios encourage critical thinking and strategic planning, making it a valuable tool for learning finance.

5. The Stock Market Game

Overview:

The Stock Market Game is an online simulation that allows players to trade stocks, bonds, and mutual funds in a virtual environment. It is widely used in schools and educational programs to teach students about the stock market and investment strategies.

Financial Lessons:

- Understanding the Stock Market: Players learn how the stock market works, including the mechanics of buying and selling stocks, bonds, and mutual funds.

- Investment Strategies: The game teaches various investment strategies, such as diversification and risk management, to help players build a successful portfolio.

- Long-Term Planning: The Stock Market Game emphasizes the importance of long-term planning and patience when investing in the stock market.

Why It’s Effective:

The Stock Market Game provides a realistic experience of trading in financial markets without the risk of losing real money. It’s an excellent way for beginners to learn about investing and develop a sound investment strategy.

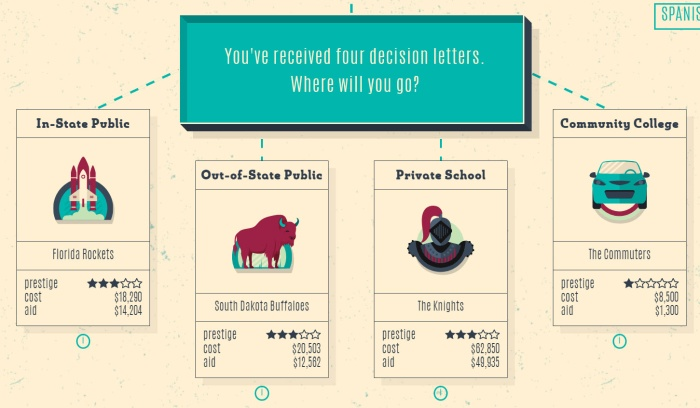

6. Payback

Overview:

Payback is an online game developed by Next Gen Personal Finance (NGPF) that simulates the financial challenges of college life. Players must manage student loans, balance work and study, and make decisions that impact their financial future.

Financial Lessons:

- Student Loan Management: Players learn how to manage student loans, including understanding interest rates and repayment options.

- Budgeting in College: The game teaches players how to budget their money during college, balancing expenses such as tuition, books, and living costs.

- Making Financial Trade-offs: Payback emphasizes the importance of making informed financial decisions and understanding the trade-offs involved.

Why It’s Effective:

Payback offers a realistic portrayal of the financial challenges faced by college students. It helps players understand the long-term implications of their financial decisions and encourages them to plan for their financial future.

7. Spent

Overview:

Spent is an online game that puts players in the shoes of someone living close to the poverty line. The game challenges players to make tough financial decisions on a limited budget, highlighting the difficulties faced by low-income individuals.

Financial Lessons:

- Budgeting on a Tight Income: Players learn how to stretch a limited income to cover essential expenses such as rent, food, and healthcare.

- Understanding the Impact of Poverty: Spent highlights the financial challenges faced by low-income individuals, such as unexpected expenses and lack of access to credit.

- Empathy and Awareness: The game fosters empathy by providing a first-hand experience of the struggles faced by those living in poverty.

Why It’s Effective:

Spent is a powerful tool for teaching financial literacy and raising awareness about poverty. The game’s immersive experience helps players understand the importance of budgeting and the harsh realities of financial instability.

8. FortuneCity

Overview:

FortuneCity is a mobile app that gamifies personal finance by combining expense tracking with city building. Players manage a virtual city, with the city’s growth dependent on their ability to track and manage their real-world expenses.

Financial Lessons:

- Expense Tracking: Players learn the importance of tracking their expenses and understanding their spending habits.

- Budgeting: The game encourages players to create and stick to a budget to ensure their city’s growth and prosperity.

- Financial Habits: FortuneCity rewards players for maintaining good financial habits, such as saving and investing.

Why It’s Effective:

FortuneCity makes personal finance fun by turning expense tracking into a game. The app’s visual representation of financial habits helps players see the impact of their financial decisions on their virtual city.

9. Moneyminded

Overview:

Moneyminded is an online game developed by ANZ Bank that focuses on teaching basic financial skills. The game covers topics such as budgeting, saving, and planning for the future through interactive scenarios.

Financial Lessons:

- Budgeting: Players learn how to create a budget and manage their expenses to achieve their financial goals.

- Saving for the Future: The game emphasizes the importance of saving money for future needs and emergencies.

- Planning and Goal Setting: Moneyminded teaches players how to set financial goals and develop a plan to achieve them.

Why It’s Effective:

Moneyminded offers a straightforward approach to learning financial skills. Its interactive scenarios make it easy for players to understand the basics of personal finance and apply them to their own lives.

10. Savings Spree

Overview:

Savings Spree is a mobile app designed for younger audiences, particularly children, to teach them about saving, spending, and making financial decisions. The game uses fun mini-games and challenges to impart essential financial lessons.

Financial Lessons:

- Saving Money: Players learn the importance of saving money and the benefits of having a savings plan.

- Spending Wisely: The game teaches children how to make smart spending decisions and avoid impulse purchases.

- Financial Responsibility: Savings Spree encourages children to think about the long-term impact of their financial decisions.

Why It’s Effective:

Savings Spree is an excellent tool for introducing children to the basics of personal finance. The game’s engaging format makes learning about money fun and accessible for younger audiences.

Conclusion

These ten games offer a diverse range of experiences that can help players of all ages improve their financial literacy. From managing a city’s budget in SimCity to navigating the challenges of student loans in Payback, each game provides valuable lessons in personal finance, investing, and money management. Whether you’re looking to teach financial skills to children or improve your own financial knowledge, these games offer an interactive and enjoyable way to learn.

Post Comment